In the world of cryptocurrency trading, market sentiment plays a crucial role in influencing price movements and investor behavior. One of the tools used to gauge market sentiment is the Fear and Greed Index. While this index is widely known in the context of Bitcoin, its applications and relevance extend to other cryptocurrencies, including Ethereum (ETH). This article provides a comprehensive overview of the Ethereum Fear and Greed Index, its significance, methodology, and how it can be used to inform investment decisions.

What is the Fear and Greed Index?

The Fear and Greed Index is a tool designed to measure the prevailing sentiment in the cryptocurrency market, specifically focusing on fear and greed among investors. The index aims to capture the emotional state of the market, which can often drive price fluctuations and investment decisions.

Origin and Purpose

The Fear and Greed Index was initially popularized by its use in traditional financial markets, such as stock exchanges. It was later adapted for cryptocurrencies to provide insights into the emotional dynamics of the digital asset market. The primary purpose of the index is to help investors understand market sentiment, which can be a valuable indicator of potential price movements.

The Ethereum Fear and Greed Index: Overview

The Ethereum Fear and Greed Index specifically focuses on Ethereum, the second-largest cryptocurrency by market capitalization. Like its counterpart for Bitcoin, the Ethereum Fear and Greed Index measures the level of fear or greed in the Ethereum market, offering insights into investor sentiment and potential market trends.

Key Components of the Ethereum Fear and Greed Index

| Component | Description |

|---|---|

| Volatility | Measures the level of volatility in Ethereum’s price. |

| Market Momentum | Assesses the strength of Ethereum’s price trends. |

| Social Media Sentiment | Tracks mentions and discussions about Ethereum on platforms like Twitter. |

| Search Trends | Measures the frequency of searches related to Ethereum on search engines. |

| Trading Volume | Reflects the amount of Ethereum being traded on exchanges. |

| Surveys and Polls | Captures the emotional state of market participants through investor surveys. |

How the Ethereum Fear and Greed Index is Calculated

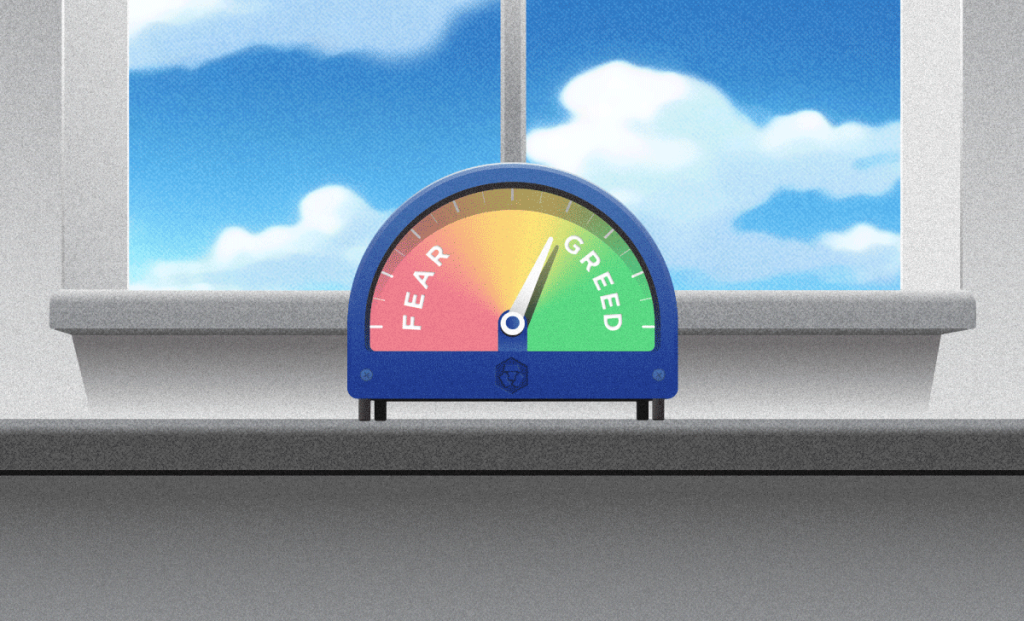

The Ethereum Fear and Greed Index is typically calculated using a weighted average of the key components mentioned above. Each component is assigned a specific weight based on its relevance and impact on overall market sentiment. The index is then presented as a numerical value on a scale, often ranging from 0 to 100, where:

| Index Value | Sentiment Level | Description |

|---|---|---|

| 0 to 25 | Extreme Fear | High levels of fear and pessimism in the market. |

| 26 to 50 | Fear | Moderate levels of fear and caution. |

| 51 to 75 | Greed | Increasing levels of greed and optimism. |

| 76 to 100 | Extreme Greed | Strong greed and enthusiasm driving the market. |

Significance of the Ethereum Fear and Greed Index

The Ethereum Fear and Greed Index serves several important functions for investors and traders:

- Market Sentiment Analysis: Helps investors understand the emotional state of the market, providing insights for informed investment decisions.

- Trend Identification: Signals shifts in market trends, indicating potential market bubbles or corrections.

- Contrarian Strategy: Serves as a contrarian indicator; extreme fear may signal buying opportunities, while extreme greed could prompt selling.

- Risk Management: Assists investors in managing risk by recognizing periods of heightened fear or greed.

Using the Ethereum Fear and Greed Index in Investment Decisions

Incorporating the Ethereum Fear and Greed Index into your investment strategy involves analyzing its readings alongside other factors and indicators. Here are some ways to use the index:

- Complementary Tool: Use the index alongside technical analysis, fundamental analysis, and other market indicators.

- Monitor Trends: Regularly track changes in the index to identify emerging trends and shifts in market sentiment.

- Combine with News and Events: Integrate insights from the index with news related to Ethereum, as major announcements can impact market sentiment.

- Evaluate Risk Tolerance: Assess your risk tolerance in relation to index readings, adjusting your strategy accordingly.

Limitations of the Ethereum Fear and Greed Index

While the Ethereum Fear and Greed Index provides valuable insights, it is essential to be aware of its limitations:

- Subjectivity: Relies on subjective measures such as social media sentiment and surveys, which may not always accurately reflect market conditions.

- Short-Term Focus: More effective for short-term sentiment analysis rather than long-term investment strategies.

- Market Manipulation: Social media and search trends can be influenced by coordinated efforts, impacting the accuracy of the index.

Useful Resources

For further reading and tools related to the Fear and Greed Index and cryptocurrency trading, consider the following resources:

- CoinMarketCap: A leading platform for tracking cryptocurrency prices, market capitalization, and trading volume.

- Wikipedia: Cryptocurrency: A comprehensive overview of cryptocurrencies, their history, and their impact.

- Alternative.me Fear & Greed Index: A specific tool for tracking the Fear and Greed Index across multiple cryptocurrencies, including Ethereum.

- CoinMarketCal: A calendar of events in the crypto world that can help plan investments and assess the impact of news on prices.

The Ethereum Fear and Greed Index is a valuable tool for understanding market sentiment and making informed investment decisions in the Ethereum market. By providing insights into investor emotions and behavior, the index helps traders and investors navigate the complexities of the cryptocurrency market.

While the index offers useful information, it should be used in conjunction with other analysis methods and indicators to form a comprehensive investment strategy. By staying informed and considering multiple factors, investors can better manage risk and seize opportunities in the dynamic world of cryptocurrency.