In the rapidly expanding world of cryptocurrency, the demand for secure and efficient trading platforms is growing at an unprecedented rate. With thousands of cryptocurrencies available, traders need reliable platforms to exchange their digital assets, driving the growth of crypto exchanges. Whether you are an experienced entrepreneur or a tech enthusiast, creating your own crypto exchange can be a lucrative and innovative venture. In this guide, we will delve deeper into the steps necessary to create a successful crypto exchange platform, offering insights and actionable tips to navigate this complex yet fascinating process.

Understanding the Types of Crypto Exchanges

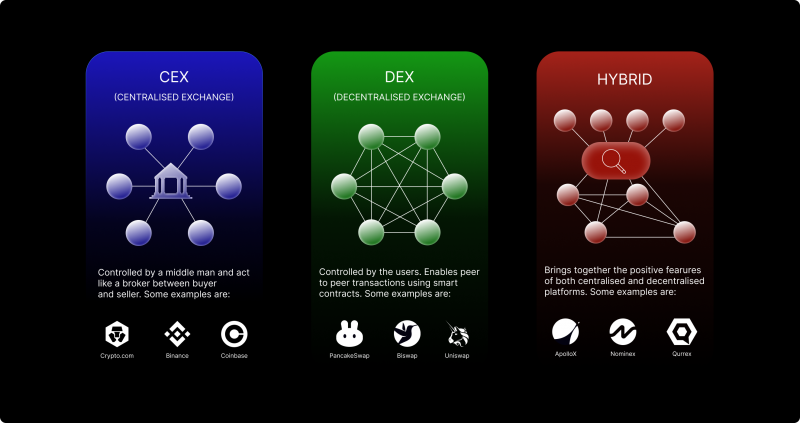

Before you begin, it is crucial to understand the different types of crypto exchanges available. Exchanges typically fall into three primary categories: Centralized Exchanges (CEX), Decentralized Exchanges (DEX), and Hybrid Exchanges. Each type offers distinct advantages and challenges.

- Centralized Exchanges (CEX): These are managed by a central authority, offering features like high liquidity, a wide range of trading pairs, and user-friendly interfaces. Examples include Binance and Coinbase. However, CEX platforms require users to trust them with their funds, which can pose significant security risks.

- Decentralized Exchanges (DEX): DEXs, like Uniswap and PancakeSwap, operate without a central authority. They allow peer-to-peer transactions, meaning users maintain control over their funds at all times. This enhances security, but DEXs often face liquidity and user experience challenges.

- Hybrid Exchanges: Hybrid platforms, such as Qurrex, combine the features of both CEX and DEX models. They aim to offer the security and privacy of decentralization while maintaining the liquidity and ease-of-use typical of centralized exchanges.

The table below highlights key differences between these types of exchanges:

| Exchange Type | Key Characteristics |

|---|---|

| Centralized (CEX) | High liquidity, ease of use, potential security concerns |

| Decentralized (DEX) | Enhanced security, user controls funds, lower liquidity |

| Hybrid | Combines CEX and DEX features, balances security and liquidity |

Key Components of a Successful Crypto Exchange

Building a successful crypto exchange involves several essential components. Each plays a pivotal role in ensuring the platform’s security, efficiency, and scalability.

1. Technology Stack

Choosing the right technology stack is critical for the performance and scalability of your exchange. The backend typically includes frameworks like Node.js or Python, which are known for handling high traffic and supporting scalable applications. The frontend can be built with React.js or Vue.js, offering a smooth and responsive user interface.

Key elements of the technology stack:

- Trading Engine: The core of the exchange, it matches and processes buy/sell orders quickly and accurately.

- User Interface (UI): An intuitive, easy-to-navigate UI can greatly enhance the user experience.

- Database: SQL or NoSQL databases like MySQL or MongoDB are commonly used to store user data and transaction records.

2. Security Measures

Security is paramount for crypto exchanges, as they are frequent targets of cyberattacks. To mitigate risks, implementing strong security protocols is non-negotiable.

Key security features include:

- Two-Factor Authentication (2FA): Adds an extra layer of security by requiring users to authenticate through an additional device.

- Cold Wallet Storage: Storing a majority of users’ funds in offline cold wallets ensures they are inaccessible to hackers.

- Encryption: Encrypting sensitive data, including personal information and wallet keys, prevents unauthorized access.

- Regular Security Audits: Continuous testing and audits to identify and patch vulnerabilities.

Here’s a breakdown of essential security features:

| Security Measure | Purpose |

|---|---|

| Two-Factor Authentication (2FA) | Strengthens account security |

| Cold Storage | Safeguards digital assets from online attacks |

| Encryption | Protects sensitive user data and transaction information |

3. Liquidity Solutions

Liquidity is crucial for the smooth functioning of an exchange. Without liquidity, trades cannot be executed efficiently, resulting in poor user experience. You can provide liquidity through:

- Market Makers: Professional traders or firms that supply liquidity by constantly offering buy and sell orders.

- Liquidity Pools: Common in DEXs, liquidity pools allow users to contribute their funds, ensuring continuous trading.

4. User Experience (UX)

An excellent user experience is one of the key differentiators between successful and unsuccessful exchanges. Users appreciate easy-to-navigate interfaces, fast transaction speeds, and access to advanced trading tools. Consider the following UX elements:

- Responsive Design: Ensure your platform works seamlessly on both desktop and mobile devices.

- Customer Support: Provide multiple support channels such as live chat, email, or even a dedicated help center for troubleshooting.

- Advanced Trading Tools: Incorporate tools like stop-limit orders, margin trading, and real-time market analytics to cater to advanced traders.

Regulatory Considerations

Navigating the complex regulatory landscape is one of the most challenging aspects of running a crypto exchange. The cryptocurrency industry faces stringent regulations in most countries, often requiring exchanges to follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

1. Licensing

Regulatory requirements vary depending on the jurisdiction. It is important to obtain licenses to operate legally. In countries like the U.S., crypto exchanges need to register with agencies such as FinCEN and comply with the Bank Secrecy Act. In contrast, some jurisdictions like Malta and Estonia offer favorable environments for crypto businesses with simplified licensing procedures.

2. Compliance with AML and KYC

Most jurisdictions require exchanges to implement AML and KYC protocols. These measures prevent illegal activities like money laundering and fraud. Ensure your platform has the necessary infrastructure for:

- KYC Verification: Collect and verify user identities before allowing them to trade.

- AML Procedures: Monitor suspicious activities, report large transactions, and adhere to local financial regulations.

3. Tax Reporting

Many countries now require crypto exchanges to report user transactions for tax purposes. Keeping accurate records of trades, withdrawals, and deposits is essential to meet these regulatory obligations.

Marketing and Growth Strategies

Once your platform is built and compliant with regulations, you need a solid strategy to attract users and grow your platform. The following steps can help you build a successful user base:

- Incentive Programs: Offer referral bonuses, trading fee discounts, or other rewards to incentivize new signups.

- Partnerships: Collaborate with well-established crypto projects and blockchain networks to enhance credibility and visibility.

- Educational Content: Provide tutorials, market insights, and guides on crypto trading to help new users gain confidence.

A list of additional considerations for marketing:

- Run email campaigns highlighting new features, trading pairs, or incentives.

- Utilize social media marketing to engage with crypto communities.

Interesting Links

- Rewisoft – provides an in-depth look at the process of creating a crypto exchange, highlighting best practices for integrating third-party services like bank cards and electronic wallets.

- CryptoNews – An article from Cryptonews offers a step-by-step guide, from understanding the market to choosing the right technology stack and obtaining licenses.